A new chapter is unfolding, in which building a local chip ecosystem is not only a policy goal, but also a bet on the future.

In the past few years, geopolitical tensions, global supply chain disruptions, and the competition for technological dominance have highlighted the importance and vulnerability of the semiconductor supply chain, putting the semiconductor industry in the spotlight. Today, governments around the world view semiconductors not only as a business opportunity, but also as an important issue of economic independence and national security.

For Middle Eastern countries, this wake-up call has triggered greater changes. A new chapter is unfolding, in which building a local chip ecosystem is not only a policy goal, but also a bet on the future.

In Saudi Arabia and Oman, building a local semiconductor industry is part of a grand plan to reduce the economy's reliance on oil revenues and create high-tech industries that can drive future growth. These countries are taking a long-term view, investing in talent, infrastructure, and partnerships to develop local chip design and manufacturing capabilities.

Egypt is not starting from scratch. The country has a long history in microelectronics and semiconductor design, with a strong engineering community, research centers, and startups active in the field. Now, Egypt is looking to scale up by attracting investment, expanding the ecosystem, and consolidating its position as a regional design hub.

This article will take a deep dive into how Egypt, Saudi Arabia, and Oman have become the focus of the semiconductor field. The article covers the latest initiatives, investments, and collaborations in these countries over the past three years, showing how each country is navigating its own path in this key industry.

Egypt: An emerging semiconductor innovation and design hub

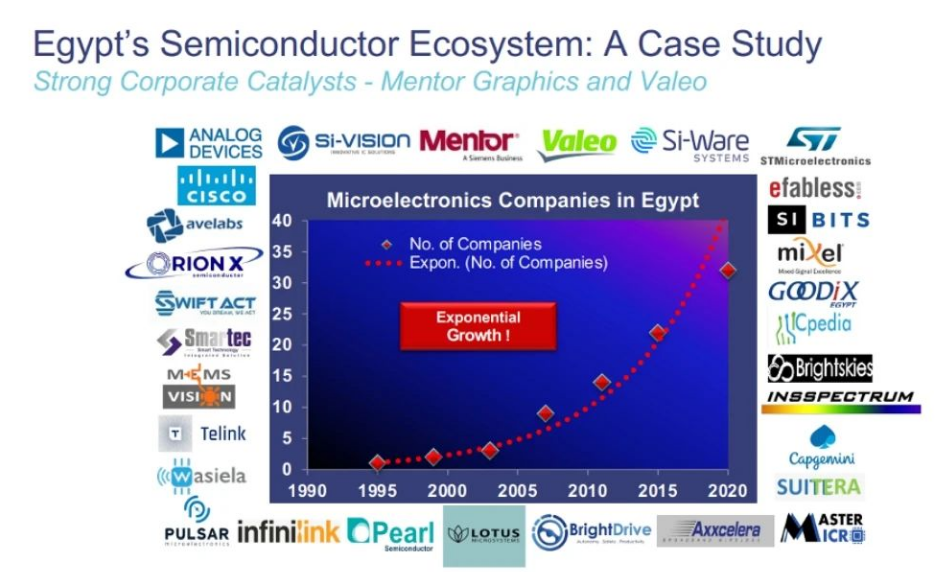

Egypt has steadily built one of the most vibrant semiconductor ecosystems in the Middle East and North Africa, though the success did not come overnight. The effort began nearly 20 years ago when Hisham Haddara, a former Memscap and Mentor Graphics executive, co-founded Si-Ware Systems, Egypt's first fabless semiconductor company. At the time, the idea of designing advanced chips in Cairo sounded ambitious, if not a little unrealistic. But the bold move planted the seeds for what would become a thriving ecosystem centered around Egypt's engineering talent and a long-term vision for global competitiveness.

Egypt's reputation in chip design has steadily grown, attracting the attention of global players and inspiring a new generation of local semiconductor entrepreneurs.

National strategy to expand "Electronics Made in Egypt"

The Egyptian government launched the Made in Egypt Electronics (EME) initiative in 2016 through the Ministry of Communications and Information Technology. In recent years, the strategy has been upgraded to EME 2.0, laying the foundation for the expansion of Egypt's electronics and semiconductor industries.

Egypt aims to position itself as a regional electronics and semiconductor design hub. Its strategy is based on two pillars:

The innovation pillar supports local fabless semiconductor startups and promotes innovation and product development.

The manufacturing pillar encourages job creation in labor-intensive electronics manufacturing. Currently, Egypt has major manufacturing operations of global giants such as Samsung and LG, as well as local industry leaders such as Elsewedy (smart meters) and Elaraby (consumer electronics).

Egypt's semiconductor strategy deliberately avoids the high cost of building semiconductor factories, and instead focuses on the strategic advantages of design and system integration until the local ecosystem is strong enough to justify large-scale investment.

Global companies are optimistic about Egyptian talent

Egypt's strong talent pool, especially in the fields of electronic engineering and embedded systems, has attracted the attention of multinational companies. In the past decade, global technology giants have set up design centers in Egypt for the development of integrated circuits and intellectual property, integrating Cairo into their global design networks:

STMicroelectronics has established a large R&D center in the Maadi Technology Park, focusing on digital and microcontroller design.

Goodix, a major Chinese chip design company, has opened an office in Cairo, focusing on IoT and automotive semiconductor solutions.

MediaTek, one of the world's top fabless companies, recently opened a design center in Cairo, consolidating Egypt's position in global chip design.

Companies such as Analog Devices, Cisco, Capgemini, and Arrow have engineering centers in Egypt, focusing on ASIC design, embedded systems, and next-generation automotive technologies.

Thriving local fabless ecosystem

The fabless semiconductor and embedded systems companies currently operating in Egypt cover a wide range of businesses. Some build products based on their own innovations, others develop high-value intellectual property, and many provide design services to international clients:

Si-Ware Systems is a pioneer in chip-scale spectroscopy and is now a well-known global brand.

Pearl Semiconductor, a subsidiary of Si-Ware, specializes in advanced timing solutions and reference clock ICs.

InfiniLink is a new entrant into the ecosystem, developing high-speed SerDes and optical transceivers, and has raised over $10 million in seed funding.

Si-Vision works closely with Synopsys to design advanced RF IP cores (including Bluetooth and Zigbee) used in devices around the world.

ICpedia, Pulsar Micro, and OrionX focus on chip design services, supporting clients from architecture to physical design and verification.

Embedded Software and Automotive Innovation

Complementing semiconductor hardware, Egypt's embedded software industry is thriving, especially in automotive applications. Well-known companies such as Brightskies, Avelabs, and Garraio have grown rapidly and now provide advanced software solutions to global automotive suppliers. Multinational automotive manufacturer Valeo has expanded its embedded systems development team in Egypt, leveraging local talent to develop high-end automotive technologies.

Global recognition and industry collaboration

In 2022, recognizing Egypt's strategic importance, the Global Semiconductor Alliance (GSA) established a regional office in Cairo, the first and only such office of the Alliance outside of the United States, Europe and the Far East. Since its inception, GSA Egypt has hosted two Executive Forums, attracting many prominent figures from leading global companies, local startups, investors and government stakeholders. These events provide a platform for cross-border collaboration, deal-making and strategic discussions around Egypt's potential in the global semiconductor value chain.

Saudi Arabia: Building a semiconductor powerhouse

Over the past three years, Saudi Arabia has made a clear and ambitious commitment to becoming a regional leader in semiconductor technology. This effort is closely tied to the broader economic transformation under Saudi Vision 2030, which positions semiconductors not only as a new industrial focus but also as a strategic pillar for building a knowledge-based economy and reducing dependence on oil revenues.

A national strategy with clear intentions

At the heart of Saudi Arabia's semiconductor ambitions is a coordinated strategy aligned with Vision 2030. The government prioritizes technological advancement, innovation, and industrial localization, placing the semiconductor industry at the center of national development goals.

In March 2022, Saudi Arabia launched the Saudi Semiconductor Program (SSP), a foundational initiative to strengthen the country's chip design capabilities and localize semiconductor technology development and production. The SSP also supports academic research, chip simulation and layout tools at universities, and chip packaging, testing, and characterization services through the King Abdulaziz City for Science and Technology (KACST) laboratory.

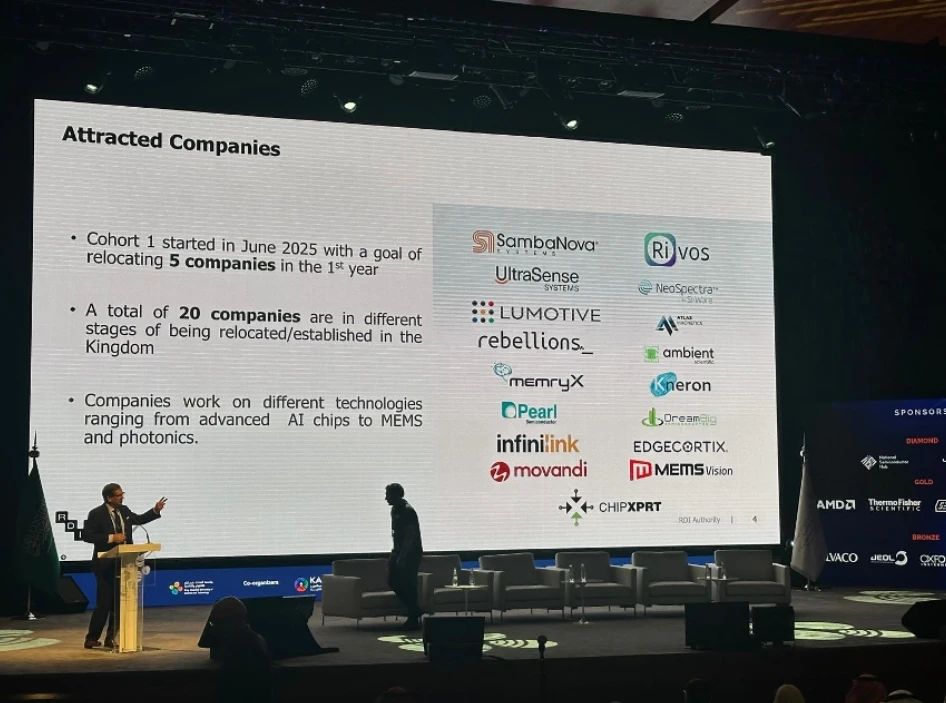

Driven by this momentum, Saudi Arabia launched the National Semiconductor Hub (NSH) in 2024 with an initial investment of $266 million. The program aims to attract at least 50 fabless semiconductor design companies to Saudi Arabia by 2030, laying the foundation for a vibrant, export-oriented design ecosystem. The NSH provides targeted fiscal incentives, fast-track regulatory support, and infrastructure tailored for semiconductor startups and multinational companies.

As of May 2025, 20 companies involved in a range of technology fields such as advanced artificial intelligence, micro-electromechanical systems (MEMS) and photonics are at various stages of relocating facilities to or establishing operations in Saudi Arabia. At the Future Semiconductor Forum hosted by King Abdullah University of Science and Technology (KAUST), the National Institutes of Health (NSH) and the Saudi Arabian Research, Development and Innovation Authority announced the establishment of a $500 million venture capital fund, managed by Apex FundRock, to provide early financing and development support to selected fabless semiconductor companies.

At the King Abdullah University of Science and Technology/Saudi Arabia National Semiconductor Future Forum, NSH Director Naveed Sherwani announced the list of companies setting up offices in Saudi Arabia. (Source: Mohammed Tmimi)

Building the foundation: research, innovation and cleanrooms

Saudi Arabia's ambitions rely on the capabilities of two world-class research institutions: KAUST and KACST, both of which provide cutting-edge infrastructure to support R&D in semiconductors and related fields.

At King Abdullah University of Science and Technology (KAUST), the Nanofabrication Core Laboratory features a 2,000-square-meter, ISO Class 6 certified cleanroom, with key process areas at ISO Class 5. The facility supports research in wide-bandgap semiconductors, microelectromechanical systems (MEMS), photonics, biomedical devices, and advanced microelectronics. KAUST's Advanced Semiconductor Laboratory is equipped with a metal organic chemical vapor deposition reactor and other specialized tools critical to the development of wide-bandgap and optoelectronic devices.

In Riyadh, KACST leads the country's applied semiconductor research efforts through the National Semiconductor Competence Center. The center provides more than 3,600 square meters of cleanroom space to support local chip design, prototyping, and advanced packaging. Recognizing the need to connect research and entrepreneurship, KACST has also launched the Ignition Incubator program specifically for semiconductor startups at The Garage, one of the largest technology startup hubs in the Middle East. With more than 300 startups, The Garage provides a dynamic support environment including training, lab access and a network of investors to help semiconductor startups scale quickly.

Driving industrialization through Arat and manufacturing leap

Saudi Arabia is also looking downstream, toward manufacturing. That's where the Alat project comes in. Backed by the Public Investment Fund, the $100 billion Alat project aims to turn Saudi Arabia into a high-tech manufacturing hub.

Alat's reach extends beyond chips. It specializes in semiconductors, but also in smart devices, medical technology, industrial equipment, and smart infrastructure. Its mission is clear: attract the world's top companies to produce in Saudi Arabia, taking advantage of the country's affordable renewable energy, strategic location, and huge investments in infrastructure and logistics.

One notable early success is Alat's $2 billion partnership with Lenovo, which plans to start producing laptops and servers in Saudi Arabia by 2026, a milestone in the localization of high-value technology manufacturing.

Human Factors

Saudi Arabia understands that talent is at the heart of any successful semiconductor strategy, and it places a premium on human capital development. Saudi Arabia is actively building local expertise through partnerships with global universities, hands-on training programs, and research scholarships. At the same time, Saudi Arabia is also working to attract global semiconductor experts to help train and mentor the next generation of Saudi engineers and researchers.

To support international companies entering its market, Saudi Arabia has also launched a soft landing program. The idea is simple: remove barriers and let innovation take root.

Saudi leaders understand that semiconductors are a global industry. Their development depends on international cooperation, not only with large chip manufacturers but also with small, specialized companies with unique capabilities. They know that the best ideas often come from cross-industry collaborations, informal networks, and shared research environments. If the past three years are any indication, Saudi Arabia is not only participating in the global science and technology race, but also laying the foundations to shape its future in the region.

Oman's semiconductor bet: Cautious entry into a high-risk industry

Oman has recently joined a growing list of countries exploring opportunities in the semiconductor industry. With a lack of local fabs, traditional design companies, and limited local expertise, Oman is effectively starting from scratch. However, as part of its Vision 2040, Oman does have clear economic diversification goals and is willing to invest in high-tech industries.

Rather than rushing into advanced manufacturing without a clear roadmap, Oman is taking a pragmatic approach, starting with realistic goals and starting from scratch. By attracting semiconductor companies and gradually developing local capabilities, Oman aims to reduce its reliance on oil revenues and stimulate growth in its digital economy.

Oman's most concrete move to date has been to position itself as a base for outsourced semiconductor assembly and test (OSAT) services. As a less capital-intensive sector than front-end manufacturing, OSAT offers a more viable entry point for emerging companies. However, OSAT itself is low-margin and highly competitive, and Oman must not let the OSAT business become a bottleneck to its ambitions. OSAT is now a core pillar of Oman's early semiconductor strategy, but its broader vision goes far beyond assembly and test.

Strategic foundation and early stage investment

In 2022, GS Microelectronics (GSME), a US semiconductor design and manufacturing services company, opened a technology center in Muscat, marking initial progress towards this larger goal. The move was supported by Oman's Ministry of Transport, Communications and Information Technology, Ministry of Labor, and state-owned investment entity ITHCA Group. GSME's partnership established the first chip design office in Oman, a milestone for a country with no experience in this field. GSME is currently successfully operating its integrated circuit design center, and more than 100 Omani engineers have been trained in chip design and verification by the company's international team.

In May 2025, Oman advanced its semiconductor ambitions when ITHCA Group invested in US-based Lumotive to partner with GSME to establish a LiDAR design and support center in Muscat.

In the same month, Oman took a key step in building its semiconductor design ecosystem by establishing a VLSI design center in Muscat through a strategic partnership with Kaynes Semicon, a subsidiary of India's Kaynes Technology, and local stakeholders.

Meanwhile, Invest Oman, Oman's premier investment promotion agency, is actively inviting international OSAT experts to consider doing business in Oman. The estimated investment in the OSAT program is between $130 million and $140 million, of which about $110 million is for capital expenditure. The goal is to establish Oman as an attractive regional base for semiconductor assembly, test, and ultimately advanced packaging services.

The larger goal is to build not just a few OSAT factories, but a more complete ecosystem covering AI chip development, design services, and the creation of high-tech jobs. However, these goals still require continued investment, international cooperation, and significant human capital development.

A seat at the global negotiating table

Oman is not content to develop in obscurity. In February 2023, the country hosted the first International Semiconductor Executive Summit (ISES) Middle East, which brought together industry leaders from around the world. The summit not only raised Oman's profile as a new semiconductor player, but also enabled it to play an important role in regional semiconductor discussions and attracted senior leaders from leading companies such as SK Hynix, Nvidia and Renesas.

The second summit is planned for December 2025, which shows that Oman recognizes the importance of ecosystem positioning and soft power.

Key figures from the Oman International Semiconductor Executive Summit (Source: Mohammed Tmimi)

A long and challenging road

Oman faces several serious challenges to its semiconductor development goals:

Talent shortage. The country currently lacks a domestic workforce with experience in semiconductor design, packaging, or manufacturing.

Supply chain constraints. Access to key raw materials, tools, and partners is complicated by geography and economic conditions.

Funding challenges. Even back-end operations like OSATs require significant investments, cleanroom facilities, and precision equipment.

Global competition. Oman's entry into the field comes at a time when other countries, including larger and more resource-rich ones, are doubling down on their own semiconductor strategies.

Good start, but execution is key

Oman's foray into semiconductors is thoughtful and well-paced, reflecting its geopolitical awareness and willingness to take a long-term view. By prioritizing OSAT (foundry packaging and testing), attracting partners such as GSME, and raising international awareness through ISES, Oman is laying the foundation for a differentiated position in the Middle East.

But the road ahead is not easy and full of uncertainty. Oman must support its vision with deep investment in human capital, cross-sector coordination, and bold and rigorous execution.

Final Thoughts

Egypt, Saudi Arabia, and Oman are not all trying to do the same thing, and that's what makes their stories so fascinating. Each country is approaching the semiconductor challenge in its own way, tailored to its resources, priorities, and vision for the future.

Egypt is building on its existing strengths: a large pool of talented, multilingual engineers and a long history in chip design. Egypt is not starting from scratch, but what it lacks is the venture capital needed for deep tech development. Egypt has plenty of talent, but not the willingness to invest to match it.

Saudi Arabia is approaching the challenge with a different perspective, one with big ambitions and deep pockets. It is building the foundations from scratch: the talent pipeline, infrastructure, partnerships, and research centers. It is also using its regional influence to establish itself as a destination that attracts global players. It's not just playing, it's trying to change the rules.

Oman, on the other hand, is taking a quieter, more collaborative path. It's not trying to become a chip giant overnight. Instead, it's seeking mutually beneficial partnerships, carving out a niche in the OSAT space, and gradually building local expertise. It's a considered approach - one that combines ambition with realism.

What's really powerful is that these different approaches don't cancel each other out, but rather work in synergy. Egypt's talent, Saudi Arabia's capital and scale, and Oman's emphasis on partnerships and regional positioning complement each other. Each country is attacking a different part of the semiconductor puzzle, and together they are creating a world that is greater than the sum of its parts.

They're not expecting overnight success. It's a long game that will take decades of investment, training, and coordination to pay off. But the fact that they're in it, and taking the long view, shows that the Middle East is ready to play a more active role in one of the world's most strategic industries.

Reference link

https://www.eetimes.eu/how-egypt-saudi-arabia-and-oman-are-building-the-middle-east-chip-future/

Souce: From eetimes.eu