Sales of semiconductor (chip) manufacturing equipment in Japan have shown a monthly decline for five consecutive months, and monthly sales have continued to fall below the 300 billion yen threshold, hitting an eight-month low.

The Semiconductor Manufacturing Equipment Association of Japan (SEAJ) announced statistics on the 24th that the sales of chip equipment made in Japan (3-month moving average) in February 2023 was 294.169 billion yen, compared with the previous month (January 2023). It shrank by 1.9%, showing a monthly decline for the fifth consecutive month. Monthly sales fell below the 300 billion yen mark for the second consecutive month, hitting a new low level in eight months (since June 2022, 284.584 billion yen).

Compared with the same month last year, sales of chip equipment in Japan rose slightly by 0.1% in February, showing growth for the 25th time in 26 months. The cumulative sales of chip equipment in Japan during the period from January to February 2023 will be 593.944 billion yen, a decrease of 1.1% from the same period last year. During the period from July to December 2022, the sales of chip equipment in Japan exceeded 300 billion yen for 6 consecutive months, and the sales in September 2022 were 380.9 billion yen, setting a record high in a single month.

Japan’s chip equipment global market share (converted by sales) has reached 30%, second only to the United States, ranking second in the world. SEAJ released a forecast report on January 12, pointing out that because the United States announced in October last year to strengthen its export control of chips to China, coupled with the sluggish market conditions of DRAM-centric memory (price decline), semiconductor manufacturers are cautious about equipment investment. Therefore, the sales of Japanese-made chip equipment in 2022 (April 2022-March 2023) (referring to the sales of equipment of Japanese companies in Japan and overseas) from the previous (July 7, 2022) estimated 4 trillion The 28.3 billion yen was revised down sharply to 3.684 billion yen, an annual increase of 7.0%.

SEAJ also revised down the sales of chip equipment in Japan in 2023 (April 2023-March 2024) from the previous estimate of 4.2297 billion yen to 3.4998 billion yen, an annual decrease of 5.0%. (Since 2019) fell into contraction for the first time. Japanese chip equipment giant Tokyo Power Technology (TEL) announced on February 9 that the chip front-end process manufacturing equipment (wafer factory equipment; WFE, Wafer Fab Equipment) market is currently in a situation of adjustment, but it is expected to gradually recover in the second half of 2023 , After 2024, the semiconductor and WFE market will grow strongly and enter a further growth stage.

TEL announced on March 20 that the semiconductor market is expected to further expand with the digitization of society in the future. Therefore, its manufacturing subsidiary Tokyo Electron Technology Solutions (TETS) will build a new plant in Ozhou City, Iwate Prefecture, and increase production of chip manufacturing equipment. The new plant is expected to start construction in the spring of 2024, complete and start production in the fall of 2025.

According to Japanese media, the above-mentioned new plant will become TEL’s No. 7 plant in Oshu City. After the introduction of production, TEL’s chip equipment production capacity in Iwate Prefecture will be expanded to 1.5 times the current capacity. In the future, through production optimization and other measures, The goal is to expand the production capacity by up to 2 times.

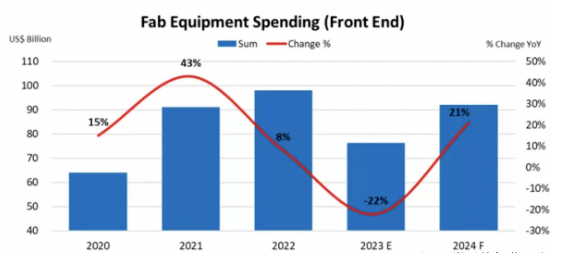

Semiconductor equipment, down 22% year-on-year

Global spending on fab equipment for front-end facilities is expected to decline 22% year-over-year from a record $98 billion in 2022 to $76 billion in 2023, according to SEMI forecasts. By 2024, it will grow another 21% year-on-year to $92 billion to recover lost ground.

The decline in 2023 will stem from weaker chip demand and higher inventories of consumer and mobile devices, SEMI said. Next year’s recovery in fab equipment spending will be driven in part by the end of the semiconductor inventory correction in 2023 and stronger demand for semiconductors in high-performance computing (HPC) and automotive. ”This quarter’s SEMI World Fab Forecast update provides our initial outlook to 2024, highlighting the steady expansion of global fab capacity to support growth driven by the automotive and computing sectors and Future semiconductor industry growth driven by a range of emerging applications.” “Report indicates healthy 21% growth in equipment investment next year.”

According to the report, Taiwan is expected to maintain its leading position in global fab equipment spending in 2024, with investment of US$24.9 billion, a year-on-year increase of 4.2%, followed by South Korea at US$21 billion, a year-on-year increase of 41.5%. While mainland China is projected to rank third in global equipment spending in 2024, U.S. export controls are expected to limit spending in the region to $16 billion, comparable to the region’s 2023 investment.

The Americas are expected to remain the fourth-largest spending region, with investments reaching a record $11 billion in 2024, a year-over-year increase of 23.9%. Europe and the Middle East are also expected to see record investment next year, with spending rising 36 percent to $8.2 billion. Spending on fab equipment in Japan and Southeast Asia is expected to rise to $7 billion and $3 billion, respectively, by 2024. The paper also said that the global semiconductor industry’s production capacity will grow by 4.8% this year, following a 7.2% increase in 2022. Capacity growth is expected to continue in 2024, increasing by 5.6%.

As more suppliers provide foundry services to increase global capacity, the foundry sector is expected to lead semiconductor expansion in 2023, with investment of $43.4 billion, down 12.1% year-on-year, and $48.8 billion in 2024, an increase of 12.4%. Despite a 44.4% year-on-year decline to $17.1 billion, it is expected to rank second in global spending in 2023, with investment rising to $28.2 billion next year. Unlike other segments, analog and power will expand steadily, driven by steady growth in the automotive market, with spending forecast to grow 1.3% to $9.7 billion in 2023. Investment in the sector is expected to remain flat next year.

The performance of global semiconductor equipment giants declined

According to the “Nihon Keizai Shimbun” report on February 18, the performance growth of global semiconductor equipment manufacturers has slowed down significantly. Among the 9 major companies, 8 companies will experience a year-on-year decline or slowdown in revenue from January to March 2023 (some companies from February to April). The reason is that the poor semiconductor market conditions have led to stagnant demand, and the US export restrictions to China have also had a certain impact. On the other hand, based on the view that almost all negative factors have been exhausted, the stock prices of related companies are also recovering rapidly. The focus of attention in the future will be the certainty and rebound strength of the performance recovery period.

American Applied Materials (AMAT) announced data on the 16th that it expects revenue from February to April 2023 to be 6 billion to 6.8 billion US dollars, a decrease of 4% to 9% over the same period of the previous year. The company’s chief financial officer Bryce Hill said at a video press conference that day: “There have been quite a few orders for memory customers that have been canceled or postponed.” Sales of logic chips and foundry companies have weakened.

During the period from October to December 2022 (AMAT is from November to January of the following year), 5 of the 9 large companies have ensured final profitability, such as Lam and Advantech. However, judging from the revenue forecasts of each company from January to March this year (AMAT is from February to April), there is a clear tendency for growth to slow down. Six companies, including Lam Group and Tokyo Electron, may see a year-on-year decrease in revenue, while profit-making companies Adesto and SCREEN holdings will see their profit growth rate at the lowest level in two years.

According to the forecast of the International Semiconductor Equipment and Materials Organization, the world semiconductor equipment market will set a record high of US$108.5 billion in 2022, but in 2023 there will be negative growth for the first time in four years. One of the reasons is that semiconductor companies reduce investment. Affected by weakening demand for smartphones and other terminals and economic slowdown, semiconductor users have begun to reduce the excess inventory accumulated in recent years, and the semiconductor market is rapidly deteriorating. In particular, the equipment investment of large memory companies that are more affected will drop sharply in 2023. The equipment investment of SK Hynix in South Korea will decrease by more than 50% compared with the previous year, and that of Micron Technology in the United States will decrease by about 40%.

Export restrictions imposed by the United States on China have also become a burden. Lam predicts this will have a sales impact of $2 billion to $2.5 billion in 2023. Demand for equipment from companies outside the U.S. is also dwindling as equipment investment by Chinese semiconductor companies stagnates. From October to December 2022, Tokyo Electron’s sales to China accounted for 22%, a drop of about 5 percentage points from the same period last year.

Hiroshi Kawamoto, executive director of Tokyo Electronics, said: ”If American equipment cannot enter, it will be difficult for Chinese customers to produce. As a result, our equipment cannot enter either.”

Post time: Mar-29-2023