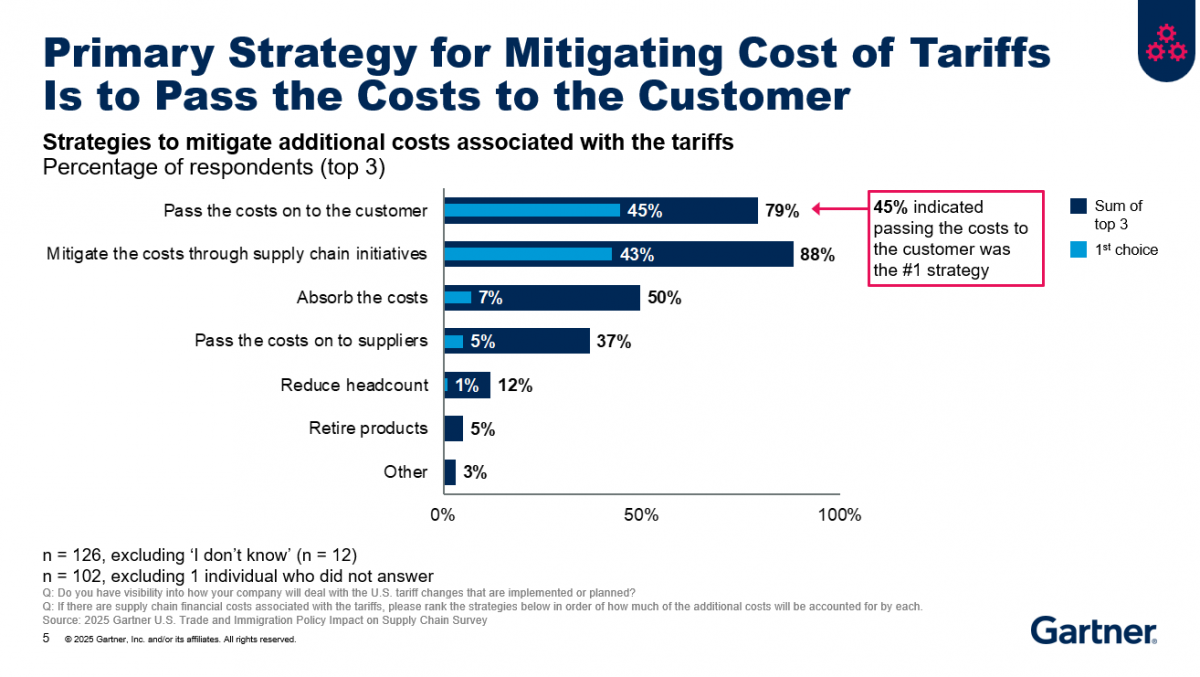

According to Gartner, 45% of supply chain leaders plan to pass on costs to customers as their top strategy for coping with new tariffs. Another 43% said they will reduce costs through various supply chain optimization initiatives (see Figure 1).

Gartner surveyed 126 supply chain leaders from March 17, 2025 to April 7, 2025 to understand their planned response to the new tariff policy and specific mitigation measures. Eligible organizations reported annual revenue of at least $50 million across the enterprise, and 83% of respondents were from organizations with revenue of $1 billion or more.

"Supply chain leaders have many potential levers to reduce new costs associated with tariffs," said Vicky Forman, senior director analyst in Gartner's supply chain practice. "While supply chain leaders are taking multiple initiatives to potentially reduce the impact, many of these actions have not yet been completed."

Figure 1: Passing costs on to customers has become the primary strategy for supply chains to cope with tariffs. Source: Gartner (April 2025)

Respondents said

92% of respondents said "increased costs" was the biggest risk associated with the new tariffs, but 75% also listed "slowing customer demand" in their top three business risk concerns. Specific risks include: a decline in overall consumer demand (mentioned by 49%), and concerns that international customer demand could be affected by retaliatory measures (mentioned by 45%).

In light of this, Forman stressed the importance of a number of supply chain initiatives that can help organizations reduce the costs of new tariffs, especially in the long run. The supply chain responses that were implemented (or planned) and that were most mentioned by respondents include:

Renegotiate supplier contracts (47%)

Explore opportunities for cooperation with suppliers (43%)

Adjust trade management strategies such as origin and valuation (40%)

Move supply locations outside the United States (39%)

Move production locations outside the United States (26%)

Pre-stock (23%)

Source: https://www.esmchina.com/news/13065.html