According to one of the world's largest memory manufacturers, the DRAM supply shortage is expected to continue until 2028.

The mainstream PC market is facing a long-term imbalance between memory supply and demand, a situation reportedly expected to persist until 2028. An internal analysis by SK Hynix indicates that growth in "commodity-grade" DRAM will be very limited, failing to meet market demand. We already know DRAM prices are exorbitantly high, but this situation seems to have spiraled out of control, making it difficult for the general public to purchase reasonably priced PCs.

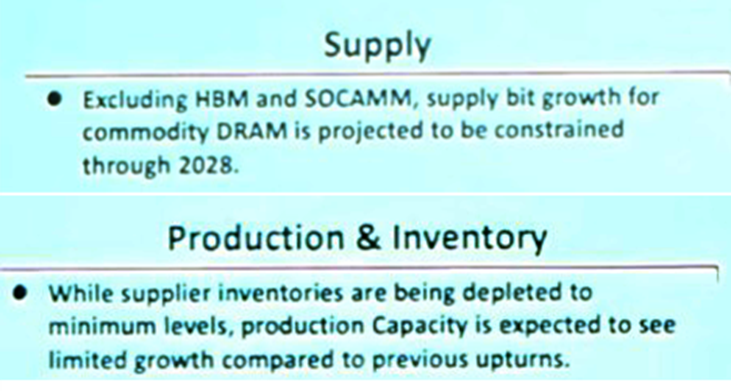

User @BullsLab shared a screenshot purportedly from an internal SK Hynix analysis. This analysis predicts that, apart from high-bandwidth memory (HBM) and SOCAMM modules, growth in general DRAM will remain limited until at least 2028. This is because major memory manufacturers have shifted their focus to meeting the demands of AI servers, and the likelihood of significant growth in capacity for the consumer market remains low.

Reports indicate that existing supplier inventories have fallen to historic lows, further exacerbating allocation pressures. The report shows that memory manufacturers like SK Hynix have adopted a conservative capacity expansion strategy, focusing more on maintaining profitability rather than flooding the market with new DRAM products. Demand for server DRAM is growing almost exponentially, with even faster growth expected next year.

The server share is estimated to surge from 38% in 2025 to 53% in 2030. Driven by the booming development of artificial intelligence, cloud service providers are heavily investing in AI training data centers, which is expected to trigger a DRAM supercycle. Some reports also indicate that manufacturers' key DRAM production quotas for 2026 are already sold out, while traditional PC DRAM production is expected to be unable to meet demand in the coming years.

We have already seen a surge in the market share of AI PCs, with AI PC systems projected to account for approximately 55% of the entire PC market by 2026, although overall PC shipments are expected to remain flat by 2025. Regarding NAND flash memory, SK Hynix's analysis also suggests that due to higher (and more profitable) demand in the server market, NAND flash memory supply growth may lag behind consumer market demand growth.

In conclusion, this analysis reveals a worrying trend in the consumer market. We previously expected this situation to continue until 2027, but it now appears unlikely to stop before the end of 2028.

The DRAM Contracts

Apple's long-term DRAM contracts are expiring, and a price increase is imminent

A company's trillion-dollar market capitalization isn't enough to shield it from global component shortages, meaning Apple will almost certainly have to pay huge sums to purchase DRAM chips from companies like Samsung and SK Hynix for its numerous products.

Recent rumors suggest that Apple's long-term agreements (LTAs) with South Korean manufacturers are expiring, and these manufacturers may be preparing to charge their lucrative customers hefty premiums on DRAM chips starting in January 2026. The real question is whether Apple will pass these cost increases on to its loyal customer base.

The situation is extremely serious. Reports indicate that Samsung has not only rejected DRAM supply requests from its mobile experiences division to maximize profits but is also shifting its focus from HBM to DDR5 production, a strategy that yields higher margins. @jukan05 urged his readers on the X forum to buy as many electronics as possible, or they will suffer heavy losses.

Apple is reportedly paying higher premiums to Samsung and SK Hynix for DRAM, which will lead to significant price increases for many of its products, such as the upcoming lower-priced MacBook, the M5 MacBook Air, the iPhone 18 series, the iPhone Fold, and the redesigned OLED M6 MacBook Pro. Fortunately, the California-based tech giant has two advantages that will play a crucial role during this DRAM shortage.

First, Apple has billions of dollars in cash reserves; second, its strategy of focusing on developing its own chips allows it to absorb these cost increases. For example, the C1 5G modem used in the iPhone 16e is expected to save Apple $10 per device. While this may not seem like much, considering millions of units shipped annually, the final savings will be substantial.

Apple is reportedly set to launch its C2 chip, which has been in development for several months, later this year. This chip will be used in next year's flagship models. Furthermore, unlike other competing brands, Apple insists on using its custom A-series SoC chips exclusively in its own products.

Due to rising costs, it's rumored that other chipset manufacturers like Qualcomm and MediaTek will exclusively use the LPPDR6 chip in the Snapdragon 8 Elite Gen 6 and Dimensity 9600 next year, putting Apple in a slightly better position. However, users planning to upgrade to an iPhone next year might be surprised, as @jukan05 mentioned that Apple is likely to raise prices for products, including iPhones, in the first half of 2026.

Dell raises prices significantly

Dell, one of the largest PC manufacturers, has internally notified employees that it is preparing to significantly raise prices on multiple products due to a DRAM memory shortage.

The memory shortage appears to have spread to "mainstream" manufacturers in the PC supply chain. According to Business Insider, internal emails disclosed by Dell indicate that the company expects to raise prices on its "commercial product line" (including laptops and pre-installed PCs). This price increase is expected to be one of the largest in the company's history, with laptop and PC prices potentially rising by "hundreds of dollars." Moreover, the price increases are not limited to the memory shortage; larger capacity storage devices will also significantly increase costs. The report states that Dell's latest Pro and Pro Max series laptops and desktops will see price increases starting next week, with increases of up to $230, depending on memory configuration. Furthermore, models with 128GB of memory could see price increases of up to $765 per unit, a surprisingly large increase for consumers. In addition, gamers who want to purchase additional storage will also face significant price increases. One Dell employee predicts that the final increase could be as high as 30%, depending on Dell's contract terms, which are substantial.

Multiple products are expected to be affected by memory shortages. According to Business Insider, Dell's new pricing list shows the following price increases:

Dell Pro and Pro Max laptops and desktops (with 32GB of RAM) will increase by $130 to $230;

systems with 128GB of RAM will increase by $520 to $765;

configurations with a 1TB SSD will increase by $55 to $135;

the Dell Pro 55 Plus 4K monitor will increase by $150;

AI laptops with an NVIDIA RTX PRO 500 Blackwell GPU (6 GB) will increase by $66;

AI laptops with an NVIDIA RTX PRO 500 Blackwell GPU (24 GB) will increase by $530.

It's worth noting that Dell is one of the world's largest PC manufacturers, meaning that if the company implements widespread price increases, other competitors such as Lenovo, Acer, and ASUS are likely to follow suit, leading to a difficult year for consumers. More importantly, the memory shortage is unlikely to end anytime soon; some forecasts even suggest it could persist until 2027, meaning memory supply will remain constrained for the next few quarters.

While artificial intelligence promises to make gaming easier for humans, it also presents challenges for gamers, and purchasing a computing device appears poised to become more difficult in the future.

Semiconductors enter a supercycle

KB Securities predicted on the 15th that starting next year, the memory semiconductor cycle will expand to include servers and high-bandwidth memory (HBM), leading to unprecedented supply shortages.

Kim Dong-won, head of research at KB Securities, stated, "Driven by artificial intelligence and memory businesses, global semiconductor sales in the third quarter of this year increased by 15% quarter-on-quarter, reaching a record high of 318 trillion won. Global semiconductor sales are projected to increase by 24% year-on-year this year, reaching 1180 trillion won, surpassing the 1000 trillion won mark for the first time."

Kim added that starting next year, the semiconductor cycle will expand from a focus on HBM to include server memory and HBM, resulting in unprecedented supply shortages. This prediction stems from the growing demand for HBM, server DRAM, and enterprise-grade solid-state drives (eSSDs), as demand continues to grow with the expansion of AI inference workloads and cloud service providers increasing data processing for AI applications. While HBM is crucial in the AI training phase, the commercialization of AI services will drive rapid growth in demand for server DRAM to handle the massive amounts of data generated during the inference phase.

Kim points out, "Depending on product speed and specifications, HBM4 prices are expected to be 28% to 58% higher than HBM3E. The semiconductor market is expected to enter a supercycle, even surpassing previous supercycles."

He continues, "Samsung Electronics has a diversified ASIC customer base, primarily serving large technology companies. Its HBM shipments are projected to triple next year compared to last year. This will expand its HBM market share from 16% this year to over 35% next year, more than doubling. Despite having the world's largest DRAM production capacity, Samsung Electronics currently has the lowest valuation level, indicating that its severe undervaluation is about to be resolved."

Source: Semiconductor Industry Observer (compiled)